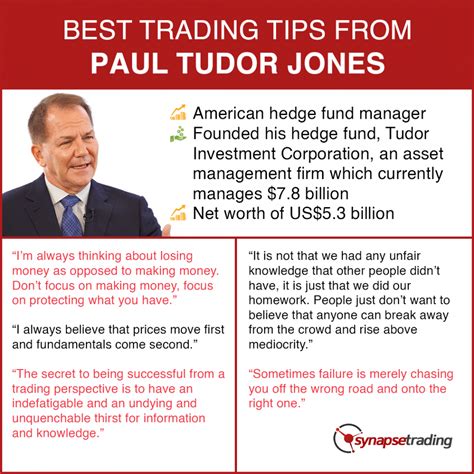

paul tudor jones trading rules | paul tudor jones elliott wave paul tudor jones trading rules Paul Tudor Jones’ trading strategy combines global macro trading which exploits the economic events across the globe, and event-driven trading that capitalizes on price movements following significant events. He incorporates extensive use of technical analysis and maintains a strong focus on risk and money management. The LV Iconic 20mm reversible belt is made with a slim profile and a double-sided strap for versatile styling. A glimmering LV Iconic buckle sits at the center for a signature House touch. Attention to detail shows through with the impeccable stitching found on both the leather and Monogram canvas sides.

0 · paul tudor jones trading secrets

1 · paul tudor jones strategy pdf

2 · paul tudor jones stock strategy

3 · paul tudor jones secrets

4 · paul tudor jones pdf

5 · paul tudor jones investment strategy

6 · paul tudor jones elliott wave

7 · pail tudor jones tips

1 talking about this

new chanel nail varnish colours

With such legendary track record, it pays to find out what are Paul Tudor Jones trading rules that brought him much success. 21 trading rules that will improve your trading. 1. When you are trading size, you have to get out when the market lets you out, not when you . Paul Tudor Jones’ trading strategy combines global macro trading which exploits the economic events across the globe, and event-driven trading that capitalizes on price movements following significant events. He incorporates extensive use of technical analysis and maintains a strong focus on risk and money management.

Lessons From A Trading Great: Paul Tudor Jones (PTJ) Macro Ops Originally published on Macro Ops Musings From Jack Schwager’s Market Wizards: October 1987 was a devastating month for most investors as the world stock markets witnessed a collapse that rivaled 1929. That same month, the Tudor Futures Fund, managed by Paul Tudor Jones, registered anWhats Known About Paul Tudor Jones’ Strategies. Paul Tudor Jones stands as one of the most renowned and influential figures in the world of finance and trading. His strategies have not only yielded significant profits but have also shaped the way traders approach the market. Understanding the methods and principles behind Jones’ success provides valuable insights . Trading Rules from Paul Tudor Jones. Jones is renowned for adopting a contrarian strategy and attempting to acquire and sell companies at pivotal moments. He keeps experimenting with trade concepts until he fundamentally changes his perspective. Otherwise, he keeps shrinking the size of his position. This video discusses the trading rules professional trader Paul Tudor Jones goes by. Trading Rules are a key part of your overall trading strategy and how to.

chanel classic flap second hand

The Top 100 Trading Rules is to repay you for all the time and attention you’ve given me. Here’s to you and your continued success! . PAUL TUDOR JONES 1. Never play macho with the market and don’t over trade. 2. If I have positions going against me, I get out; if they are going for me, I keep them. 3. Decrease your trading volume when . In my last video, I’ve profiled Paul Tudor Jones who in my opinion is one of the greatest trader ever. I’ve learned so much from him over the past 20 years t. #9 Paul Tudor Jones traded smaller during losing streaks. “When I am trading poorly, I keep reducing my position size. That way, I will be trading my smallest position size when my trading is worst.“ #10 He looked for only the very best risk/reward trading opportunities. Paul Tudor Jones, a famous hedge fund manager, is known for his use of the 200-day moving average as a key indicator in his trading strategies.He believes that when an asset’s price crosses above its 200-day moving average, it indicates a bullish trend, while a cross below signals a bearish trend.

Andy Jordan, Professional Trader - Trading Educators, shares his trading experience in this article titled, "Golden Rules by Paul Tudor Jones". Newsletter Advisory Services. Ambush Signals; Private Mentoring. Founder Joe Ross; Andy Jordan; Marco Mayer; Trading Methods. Ambush Trading Method .Discover the trading wisdom of Paul Tudor Jones, a renowned and successful trader. Learn key lessons and strategies that propelled him to extraordinary finan.

Paul Tudor Jones defined investing as a process of self-discovery. He said it may take a few failed attempts to find the right strategy that may be a good fit for an investor. . An investor should define his own trading rules and stay disciplined by sticking with them. 3. No training or classroom can prepare you for trading One such legendary fund manager was Paul Tudor Jones, whose successful trading strategies have been admired and followed by many investors across the globe for decades. Jones defined investing as a process of self-discovery. He said it may take a few failed attempts to find the right strategy that may be a good fit for an investor. “The most important rule of trading is to play great defense, not great offense.” Trading offensively is trying to grow you capital while defense is protecting what you have. Winning trades are how many points you score and losing trades is how many points you give up to the other team. With such legendary track record, it pays to find out what are Paul Tudor Jones trading rules that brought him much success. 21 trading rules that will improve your trading. 1. When you are trading size, you have to get out when .

Paul Tudor Jones, one of the most aggressive and legendary futures traders of the modern era, shares his seven rules for trading. Learn from his stellar approach. Let’s dive into Paul Tudor Jones’ trading strategy to learn how he’s maintained consistent success in the stock market over multiple decades. We’ll dissect the key principles and tactics that have made him one of the greatest traders of all time. From Jack Schwager’s Market Wizards : Octob

Here are his trading rules: 1. When you are trading size, you have to get out when the market lets you out,not when you want to get out. 2. Never play macho with the market and don’t overtrade. 3. If I have positions going against me, I get out; if they are going for me, I .

Paul Tudor Jones is known for his aggressive trading style, often making large bets on stocks and commodities. He is also well known for his ability to anticipate market movements and for his use of technical analysis when trading. Paul Tudor Jones trading rules were being long when the price is above and short out when it’s below is just like playing defense, he argues. An example of Paul Tudor Jones trading strategy is here: Moving average strategy and his trading strategy: Billionaire investor Paul Tudor Jones famously earned a 4-year streak of triple-digit returns. Here are the 7 trading rules he lives by after suffering a devastating loss. Uncover Paul Tudor Jones' strategy for consistent trading success, delving into his risk management tactics and trend following methods.

Learn the 21 trading rules from legendary investor, Paul Tudor Jones. These principles have helped him become one of the most successful traders in the world.

paul tudor jones trading secrets

paul tudor jones strategy pdf

paul tudor jones stock strategy

June 2, 2023. To accurately determine the authenticity of a Louis Vuitton belt, there are several criteria to consider such as identification numbers, buckle designs, logo quality and pattern consistency. In this comprehensive guide, we will delve into the intricacies of identifying genuine LV belts and provide valuable insights on spotting fakes.

paul tudor jones trading rules|paul tudor jones elliott wave